The churn rate is a critical metric for any business. We discuss all you need to know about the churn rate in this article.

Customer acquisition is like filling a bucket with water. The problem is… most businesses have to refill their buckets every day just to stay in business. Customers enter, purchase once, and leave for good. The water flows in and then right out of the bottom. Some bucket.

Fortunately, businesses with recurring revenue do not share the same fate. The subscription-based business model acts like a pipeline. Water flows in automatically every month, and as long as you don’t have too much leakage, your business will grow.

That leakage, of course, is churn. And managing your churn rate is the key to retaining customers and sustaining long-term growth. To help you keep your bucket full, we created a guide on how to calculate churn and the top 7 ways to minimize your churn rate.

Start your day

with great

quality

content

What is churn?

Churn refers to the portion of customers who stop transacting with a company over a certain period of time. It is typically calculated on a monthly or annual basis and reported as a churn rate percentage.

Churn can be the result of customer nonrenewal, cancelation, credit card expiration, or a variety of other reasons. It is a key figure for businesses with recurring revenue, including software-as-a-service and other subscription businesses.

Churn is a natural part of doing business, but it is also a simple way to gauge the sustainability and health of a company. A high churn rate may indicate a need to revisit fundamental aspects of the customer experience, such as pricing, features, customer service, or the onboarding process. And a low churn rate may suggest that a company is effectively meeting customer needs.

Why is it important to track churn rate?

Churn rate is one of the most important metrics for any business with recurring revenue. Here are four reasons to keep a close eye on churn:

1) Save your budget

With customer acquisition costs on the rise, it is now five times more expensive to land a new customer than to reactivate an existing one. This means that a simple 5% improvement in customer retention can increase your profits by 25% to 95%. By monitoring and reducing your churn rate, you can save your marketing budget and enjoy more of the spoils from a loyal customer base.

2) Early warning sign

A high churn rate can be a warning sign that something is wrong with your product, your pricing, or the way you are treating your customers. Because most business leaders are not on the front lines of customer service, it can be easy to miss an uptick in customer cancelations. Watching the churn rate closely can help you catch these problems early and take corrective action.

3) Helps improve the customer experience

By understanding what is causing customers to churn, you can identify areas to improve your product or service. This serves as an inherent feedback mechanism to help you make your business better. Consider implementing cancelation surveys and looking for patterns in the data.

4) Competitive benchmarking

If you are monitoring your churn rate, chances are your competitors are as well. Look for industry reports to compare your retention to that of similar companies. This will give you a sense of your relative performance and where there may be room for additional improvement.

5) Provides focus

There are a lot of distractions in business. From new product launches to hiring and marketing initiatives, it can be easy to lose sight of the things that really matter. Tracking churn rates can help you stay focused on your customers’ main pain points. If you spot an uptick in churn, be sure to realign your team on the most important priority: keeping customers happy.

How is the churn rate calculated?

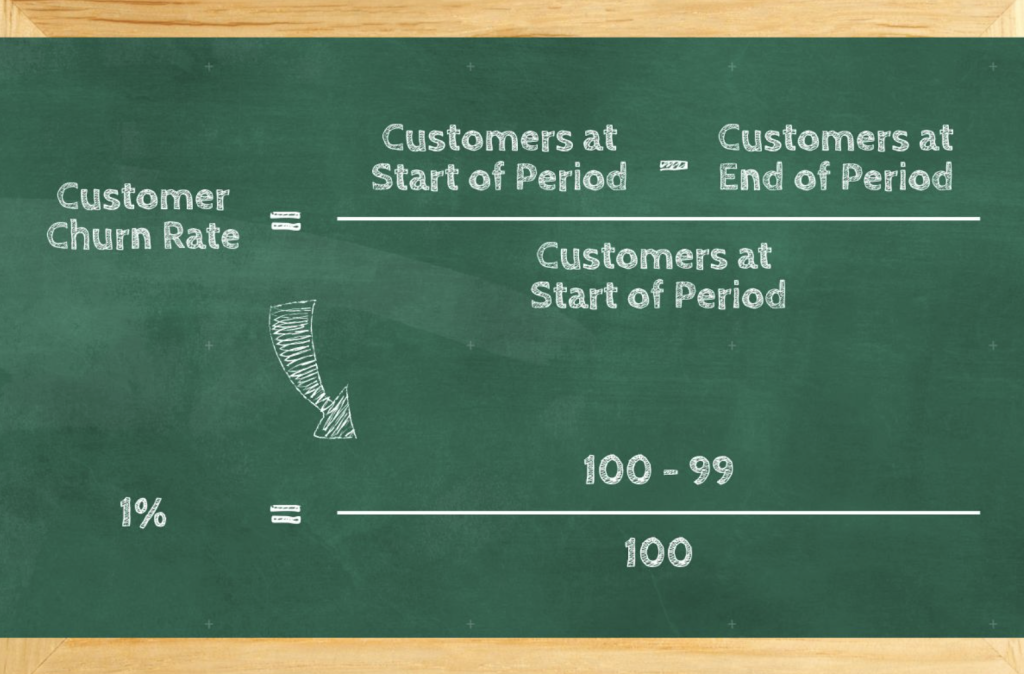

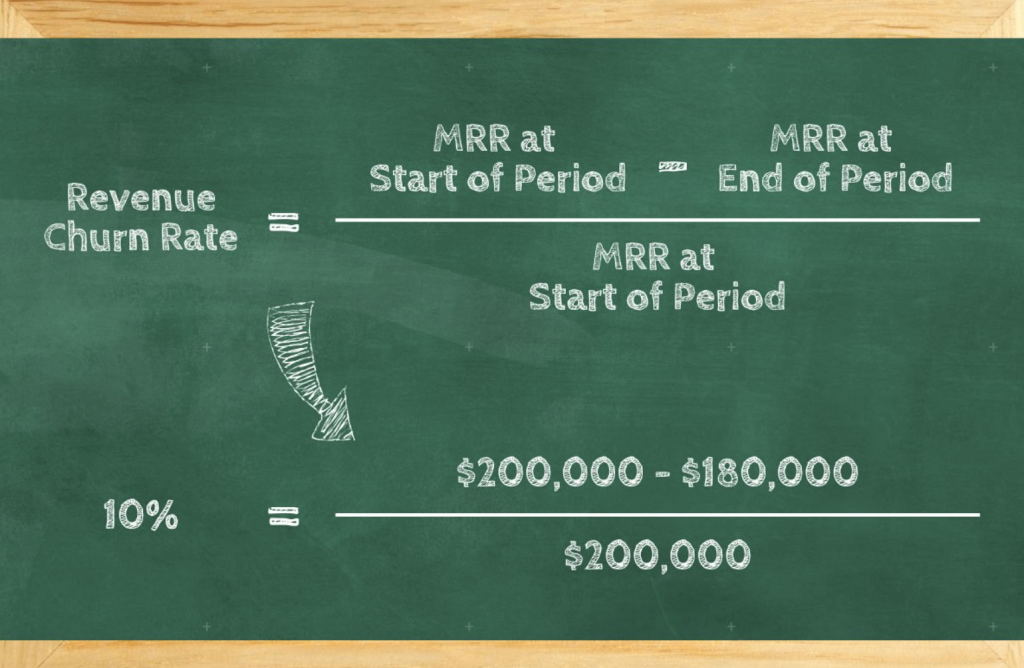

There are two primary ways to calculate churn: customer churn rate and revenue churn rate. Although they are related, the two churn rate metrics highlight slightly different consequences of churn.

Customer churn rate reveals the percentage of customers who have stopped doing business with you over a specific period of time. Revenue churn rate, on the other hand, is the percentage of recurring revenue that has been lost due to churn. While this calculation is dependent on the number of customers who have churned, what it really shows us is the size of the customer contracts that churned.

To highlight the difference between these two churn rates, consider this hypothetical example. LeanCo software company has 100 customers, and in the month of May, LeanCo loses one customer to churn. If all else remains equal, this represents a 1% customer churn rate.

However, suppose the lost customer was on an enterprise-level subscription that generated $20,000 per month and LeanCo had been operating with $200,000 of monthly recurring revenue (MRR). If all else remains equal, then this single cancelation would represent a 10% revenue churn rate.

If your pricing model only offers one tier of service, then the customer churn rate and revenue churn rate will be the same. However, if you offer multiple pricing tiers (as in this example), then you will likely want to track both churn rates. This can help you better understand where you are losing customers and who to target with churn prevention efforts.

7 tips for keeping the churn rate low

There is no magic number with regard to churn rate—what is acceptable for one company may be alarming to another. Despite these differences, there is one common goal among all businesses with recurring revenue: keep churn as low as possible.

To minimize your churn rate, follow these 7 churn management tips:

1) Get to know your customers

This may seem like a no-brainer, but it is important to keep churn in mind when building customer relationships. The more you know about your target market, the better you can serve them.

Take this as an opportunity to revisit your customer personas. Study the unique needs and desires of each persona, and keep tabs on customer churn rate by segment. This may help you develop a sense of which types of customers are at risk.

2) Collect customer feedback

By constantly soliciting customer feedback, you can get ahead of churn. Send NPS surveys and feature request surveys on a regular basis, and use this information to guide product development.

Prioritize the features that will have the biggest impact on customer (and revenue) retention. And when you release them, make sure to let your customers know. This can foster engagement and demonstrate that you are committed to meeting their needs. For this same reason, consider sharing your product roadmap publicly.

3) Improve customer service

Customer service is your first line of defense for preventing churn. Make sure your team is equipped to offer technical, product, and account support during the hours your customers need it most.

For requests that can be resolved, ensure your team does so quickly and then documents the solution. Upload these resources to a knowledge base or FAQ page so that customers can reference them in the future.

And if there are any unresolved or unresolvable customer support requests, assign these inquiries to your development team. These tickets can offer valuable insights into areas where your product is falling short.

4) Offer incentives for loyalty

Consider implementing a loyalty program to reward customers for sticking with your product. This could take the form of discounts, freebies, or early access to new features.

Service businesses often use this strategy in the form of a tiered pricing model, in which customers who commit to longer terms receive a lower rate. Similarly, software businesses can incentivize loyalty with annual subscription plans or by offering a discount for customers who prepay.

These strategies improve customer lifetime value (CLV), attract higher-value customers, and reduce the number of opportunities for billing errors to create churn.

5) Identify churn warning signs

There are a number of churn warning signs that every business should be on the lookout for. By identifying these early, you can take steps to prevent churn before it happens.

Some common red flags include:

- Reduced usage: If a customer is using your product less frequently or for shorter and shorter sessions, this could be a sign that they are on the brink of churning. As much as possible, keep tabs on individual user activity and look for any sudden changes in behavior.

- Unresolved support requests: If a customer has unresolved support requests, there is likely room to improve their satisfaction. Consider contacting the customer directly and offering to help where you can.

- Negative feedback: An uptick in negative feedback is always a cause for concern. If you’re seeing more complaints than usual, take the opportunity to reach out and see how you can improve the customer experience. This will give you the chance to learn from customers that have churned, and show those who have not that you are invested in their needs.

6) Implement a cancellation flow

When customers do decide to churn, a thoughtful cancellation flow can give you the chance to save the relationship. This process should be designed to uncover the reasons for churn and give customers the opportunity to address them.

In some cases, you may be able to offer a solution that meets their needs and keeps them on as a paying customer. For example, if the customer’s business is seasonal, you may be able to “freeze” their account for a discounted rate. Or, if the customer hasn’t had the chance to fully explore your product, you could offer a free trial extension.

And if you can’t retain the customer, use their feedback to improve your product or business. Gather information about why they churned and look for common themes over time. With this data, you can take steps to prevent future customers from churning for the same reasons.

7) Launch win-back campaigns

You will never be able to completely eliminate churn. Competitors emerge, businesses shut down, needs evolve, and billing mistakes can happen.

No matter the case, it’s worth reaching out to customers who have churned in an effort to win them back. These “win-back” campaigns can be tailored to address the specific needs of a churned customer and to offer them an incentive to return.

If you have launched a new feature that you think a churned customer would find valuable, reach out and let them know. To sweeten the pot, you can even offer them a free trial to test it out. Or, if you know that a customer churned due to a billing issue, offer to resolve it and give them a discount on their first invoice back.

Previous customers are some of your best prospects for re-engagement, so don’t give up on them too easily. With the right offer, you may be able to win them back and keep them as a customer for the long haul.

Final thoughts

By following these churn management tips, you can keep your retention high and your customers happy. While there are tactics you can implement to combat churn, there is no substitute for a quality product that meets the needs of your customers. Once you embrace this churn prevention mindset, you will be well on your way to improving your bottom line and building a business with loyal, long-term customers.