Spend time collecting enough data to get a reasonably reliable picture of your customer loyalty.

Think back to the last time you needed to buy a computer. If you’re an Apple user, there’s a good chance you’ll consider them again. You’ve had a good experience with them in the past. You consider them easy to use, their customer service is great and the computers last a long time. Even if they are slightly more expensive than the competition – you’ll probably head directly to the Apple store for your replacement computer.

That’s because you are loyal to Apple. In fact, 92% of Apple’s customers are brand loyal – meaning they will continue to purchase from Apple in the future.

Apple invests heavily in developing customer loyalty. They want to make sure their customers continue shopping with them across their entire product line. Why does Apple feel so strongly about customer loyalty?

Read on to find out why the importance of customer loyalty is crucial for a business’s growth.

Start your day

with great

quality

content

What is customer loyalty?

Customer loyalty is the act of choosing one company’s products and services consistently over its competitors. When a customer is loyal to one company, they aren’t easily swayed by price or availability. They would rather pay more and ensure the same quality service and product they know and love.

Customer loyalty is the result of a company consistently meeting and exceeding customer expectations. Another study by Rare Consulting says that 83% of customers said their brand loyalty stemmed from trust. In other words, loyalty is about likability and the ability to trust the product and brand. Customers who trust the companies they do business with will be more likely to purchase again in the future.

Why is customer loyalty important?

The importance of customer loyalty impacts almost every metric important to running a business. Without happy customers that continue to buy from you, the business won’t survive. New customers (as we’ll talk about below) tend to cost more to acquire and don’t spend as much money as loyal, repeat customers. Keeping customers coming back for more is critical to business success. And it’s why short-term profit grabs don’t work. Loyal customers are just better for business: they help you grow and keep profits high.

Stronger customer loyalty helps companies grow

While it’s obvious that customers who come back to spend more money are good for business, there are other, more subtle, benefits to loyal customers.

It’s like the old leaky bucket metaphor. Imagine a business as a bucket. Customers flow in and fill the bucket up. A successful business has a full bucket of customers (and profits).

However, imagine the bucket has a hole in it. Customers who flowed into the bucket start to leak out the hole. Losing customers is called churn, and it has a large effect on business growth. Even if you can somehow start filling the bucket faster, you’re still losing valuable customers. Patching up the hole (or improving customer retention) means keeping more customers in the business bucket. A 5% increase in customer retention increases business profits by 25%-95%.

If it cost the same amount to replenish the customers lost through the leak, then churn wouldn’t be such a big deal. Unfortunately, it’s much more expensive to get new customers into the bucket than continue to sell to existing customers. It’s estimated that new customers cost five times more to convert than existing customers

This means businesses with disloyal customers need to spend more of their resources on acquiring new customers. Loyal customers make it easier for businesses to grow.

Finally, loyal customers also make recommendations to family and friends. When considering if referrals are really all that important to your bottom line, consider the following stats from Referral Sasquatch:

- The lifetime Value for new referral customers is 16% higher than for non-referrals. This is likely because they already have a positive opinion of the business, and friends are more likely to recommend “perfect fit customers” or those that they know will benefit from your product or service.

- Social media posts influence the purchase decisions of 83% of US online shoppers.

- B2B companies with referrals experience a 70% higher conversion rate. Loyal customers can help expand your lead pipeline.

- 83 percent of consumers said that they would recommend a company that they trusted. Meaning trust will not only help you gain repeated business, but it will create new customers alike.

As you probably know, customer acquisition can be costly, so growing your customer base organically is always a plus.

Investing in company loyalty isn’t just about preventing customers from leaving. It’s also about maximizing the opportunity for growth. Combine all these loyalty effects together, and it’s estimated that customer disloyalty can stunt growth by 25%- 50%. Yikes.

Customer Loyalty Means Higher Profits

To operate a business revenue must be greater than expenses. If it takes $100 to convert a potential customer to a buyer, they need to spend at least that much with your business for you to break even. Customer Acquisition Cost (CAC) will often include items like marketing spend, sales labor, and software cost. All those costs add up: Bain & Company believes that most businesses need to retain customers for at least 12 to 18 months to break even on the cost of acquisition. The importance of customer loyalty isn’t just a nice idea, it’s necessary to keep the business afloat.

In fact, directing resources toward improving customer loyalty is one of the best investments a business can make. A 2% increase in customer retention has the same effect on profit as decreasing operating costs by 10% (Leading on the Edge of Chaos, Emmet Murphy & Mark Murphy.) Instead of spending less money on customers, spend money on keeping customers around – the payoffs are worth it!

As a final point, repeat customers are often the most profitable. McKinsey found that repeat e-commerce customers spend more than double what new customers spend ($52.50 average cart size for repeat customers, compared to $24.50 for new customers). SaaS businesses can see a similar benefit by upselling existing customers and providing more value as the account grows.

A focus on the importance of customer loyalty results in higher profits and overall company success.

How do you measure customer loyalty?

Keeping a customer happy and loyal for the long term is a serious task that includes working on various processes such as:

- monitoring and observations,

- the creation of accurate data collections,

- calculations based on processed information,

- and finally, constant improvements of strategies in different business aspects.

To successfully deal with all these activities, apart from well-developed knowledge base tools that will help you keep and classify the data, you are also going to need a reliable system of metrics for tracking customer retention.

For SaaS businesses, in particular, customer loyalty is one of those murky areas that is important but often not well understood. When you stray into the realm of measuring customer loyalty, you can identify those customers who have forged an emotional connection with your brand and are likely to stay.

And instead of cursing your lost customers once it’s too late, you can take practical steps to build loyalty among your current customer base.

A customer isn’t either loyal or disloyal. There’s a loyalty spectrum. Customers can be a little bit loyal or extremely loyal. Using the metrics below will help identify how loyal customers are, and where more work needs to be done.

Lifetime Value (LTV)

Loyal customers will spend more money with you over time. This is easily measurable.

Lifetime Value is the amount of money customers spend with you from their first purchase to their latest purchase (or cancellation).

Combining customer value (AOV multiplied by purchase frequency) with the store’s average lifespan (which represents the average time of customers’ activity before they drop off), CLV provides some important information. This rate lets you know:

- How much your customers spend as time goes by

- How frequently they tend to buy your products

Accordingly, the increase in CLV positively affects customer retention since it means that the frequency and value of purchases increase over time. If you want to improve customer retention from this aspect, some of the good ideas are:

- Making your brand more attractive and open to the target group

- Providing impeccable customer service based on fast responses and accurate information

- Having a responsive website with a well-developed mobile version, making it easily accessible

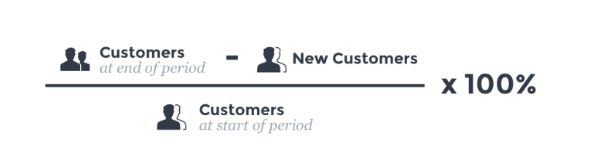

Churn Rate

Knowing your CCR will help you determine your customer lifetime value which can show you your business’ growth ability. Even though it may seem to you like something complicated, this rate is a metric whose value grows every time a customer decides to bail on your business. Keeping this rate at the lowest level is something you should pay attention to if you want your business to grow.

The higher your CCR is, the lower are chances for your business to blossom since you’ll be experiencing huge customer retention costs. Having this in mind, it’s obvious that CCR tracking is one of the key activities for any serious business. Analyzing and lowering CCR means having a larger number of loyal customers, and therefore, a higher customer retention rate. The decrease in CCR can be provoked in numerous ways, such as by:

- Meeting customers’ expectations

- Constantly adding value to your customer’s experience

- Differentiating from the competition,

- Observing market trends and being responsive to them, etc.

In addition to measuring the customers who stay, it’s also important to look at the customers who go. Disloyal customers who cancel offer a great source of learning.

From the Baremetrics SaaS academy article on measuring churn:

“There is more than one way to measure your churn. The most straightforward way is to calculate the percentage of users lost based on the number of users you started within a given time period. Do this by dividing the number of users you churned by the number you started with. That percentage will allow you to estimate how many users you may lose on a monthly or quarterly basis. However, you may also calculate your churn in terms of potential revenue loss. Each time you lose a user and their subscription, you are losing a certain amount of revenue. This is called revenue churn, and it is arguably more important than user churn. This metric is important to track because it weights your user churn in a way that more accurately represents how your business is doing.”

Referrals

If you run a referral program, it’s possible to track the number of new customers who sign up based on word of mouth. Loyal customers are happy to share great services with friends and family. Measuring referrals tracks not just customers who stick around, but also customers who are so happy they spread the word.

For example, Dropbox offers free storage to users that refer new customers. When a customer signs up through a referral link, Dropbox can attribute their future payments to referrals. As customers become power users, they will be more likely to refer family and friends to gain more storage space. Dropbox grew 3900% in 15 months using this referral strategy.

It’s also possible to track referrals as a lead source within Salesforce or other CRMs, even manually. As customers become more loyal (and your referral program becomes more structured) you’ll see referrals become a large percentage of total incoming leads. People are talking about you!

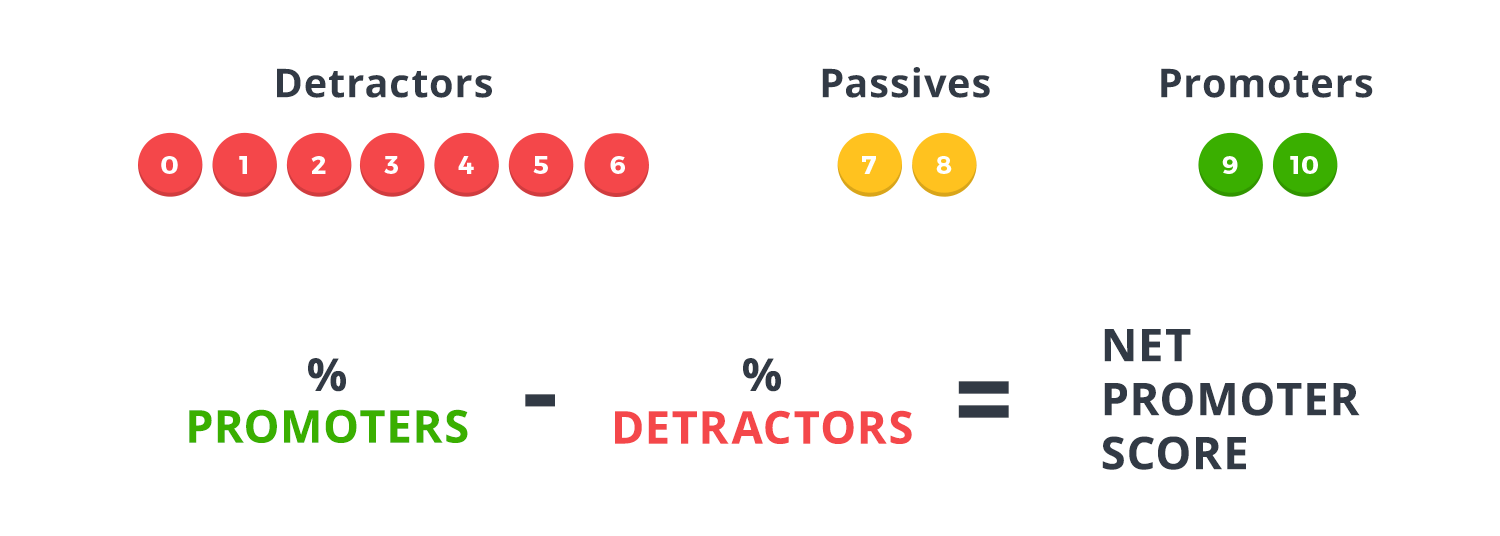

Net Promoter Score

Net Promoter Score is a well-known metric in SaaS and eCommerce but is also used by many companies across all industries.

Net Promoter Score measures customer loyalty and provides you with feedback about how well your products are received. This metric tells you how likely it is your customers will recommend your product or service to their friends and family.

Crucially, NPS plays a significant role in determining a company’s future growth, especially in industries where there is a lot of competition. When customers have real choice, a company’s promoters are the deciding factor in whether more decide to buy from you.

Your NPS can also indicate how likely your existing customers are to buy from you again.

You measure your NPS by sending your customers a short survey. In this survey, you ask your customers how likely they are to recommend your company on a scale of 1-10.

Depending on their score, your customer will either be a Detractor, Neutral or a Promoter. Your aim is to have as many customers as possible to score as Promoters to gain a high NPS.

- Scores of 0-6 are DETRACTORS

- Scores of 7-8 are NEUTRAL

- Scores of 9-10 are PROMOTERS

Get an idea of your industry’s NPS average to help you figure out where you are on the spectrum. You might think you have a low score, but are actually performing very well for your industry.

Dividing the percentage of your customers who are Promoters by the percentage who are Detractors gives you your overall NPS score. It will be between -100 and 100.

While NPS is often considered The Ultimate Question when measuring the importance of customer loyalty, it can be a somewhat misleading metric. Why? Because NPS only measures the customer’s intent to recommend the company. It doesn’t measure action. The customer might be disloyal for other reasons in the future – perhaps they are extremely price sensitive or they have a bad service experience. Just because a customer signals they might recommend a company, doesn’t mean they will follow through.

However, NPS is still very useful for looking at overall loyalty trends in the user base, and for uncovering Promoters that might be helpful in the future. NPS could be considered a “leading indicator” of loyalty.

Six Stages of Customer Loyalty

Customer loyalty can also be measured by the level of commitment each customer shows to the company. There are six stages in customer loyalty, and each stage increases in the amount of loyalty the customer shows. For example, a customer who is a repeat purchaser is more loyal than the customer who buys for the first time. A customer who refers a friend is more loyal than the customer who simply buys once and uses the product.

The six stages of customer loyalty are:

- Awareness – customer is aware of company and what it offers

- Research – customer is considering purchasing, and has visited website, downloaded resources, etc.

- Buy – customer has bought product or service

- Use – customer uses the service that they purchased

- Repeat – customer purchases from company again

- Refer – customer refers friends or family members to company

The goal of any company is to move the customer from stage one (awareness) all the way through to stage six (repeat buyer and referrer).

The effect of great customer service on customer loyalty

Can the customer service team play a big part in driving customer loyalty? Absolutely.

Customers love doing business with companies that offer great service. A recent Harris Interactive survey discovered that customers would pay more if they could guarantee superior service. That means that companies with great customer service will see stronger customer loyalty, and lose fewer customers solely to price competition.

Customer service teams also have a big part to play in preventing disloyalty. In that same Harris Interactive survey, eighty-nine percent of respondents who had recently switched from a business to its competitor did so because of poor service. We talk often about how high-effort experiences can cause customers to become disloyal.

Customer service teams that measure customer effort score can have a big impact on reducing friction and increasing customer loyalty.

While satisfaction may not necessarily result in loyal customers, dissatisfaction almost certainly leads to disloyalty.

But building trust doesn’t happen overnight or in a vacuum. Building trust takes a lot of work and requires you to deeply understand your customers, remain consistent, and consistently deliver. Only then will you have a brand that will keep people coming back for more.

The Future of Customer Loyalty

We used to rely on proximity to keep customers coming back. Most people would shop at the local corner store, get a savings account at the local bank, and book their annual holiday at the travel agent next door. We were loyal to local businesses because we knew the owner from soccer practice.

Today, 85% of shoppers start their search on Google, instead of at the local shopping center. Simply by typing in a description of what they want to buy, customers can compare prices across every online business. One-click and they can get it delivered the next day. Customer loyalty is decreasing as competition is increasing.

In order to attract customers, and keep them coming back, companies need to invest in building company loyalty. By meeting and exceeding expectations consistently, companies can start to build a relationship with customers.

Instead of relying on feel-good metrics alone to improve your customer retention, start measuring customer loyalty. Follow up with those customers who are at risk of churn but can still be saved. Gracefully let go of your most dissatisfied customers.

Make the most of the feedback available to you from your customers. Spend time collecting enough data to geta reasonably reliable picture of your customer loyalty.

Competing simply on price is a race to the bottom. Companies with zero customer loyalty are forced to play this game, offering deeper and deeper discounts to attract new customers. But companies who have loyal customers don’t need to compete on price.

Instead, they can leverage their strong relationship with customers to keep them coming back.